Company valuation, also known as enterprise valuation, is the process of determining the economic value of a business and provides owners and/or potential investors with an objective estimate of its worth. Although valuation is often perceived as a numerical result, it is actually an educational and guiding strategic decision process when done properly.

Understand your current business model and where your business stands in the market and competition

It helps you understand the growth potential of your business and develop more informed financial goals, strategies and marketing plans.

Valuation forms the basis of negotiations between the entrepreneur and the investor in funding rounds, providing speed and efficiency in the decision processes of investors.

Valuation assumptions are also the basis for monitoring the performance of the enterprise, as they are the entrepreneur's commitments for the future.

It is the basis for possible agreements and commitments between partners.

As Valufy, we see valuation as a fundamental process that reveals the full potential and risks of a business idea or venture, where many factors that may not have been considered at the beginning but are of critical importance are questioned and concretized in a data-driven manner, where you can see the market validity and growth potential of business models in the clearest way and thus guide your strategic decisions.

The net asset valuation approach is based on the assumption that the price a potential investor would pay to acquire a business is at least equal to the amount that would be realized by liquidating all of the assets of that business at a given date, or the replacement value of the assets. Net asset value, also known as book value, is the fair market value of the business assets minus the total liabilities on its balance sheet. Because net asset value measures only the tangible assets of an entity, it is also useful as a lower bound for a valuation range. However, this approach does not take into account the potential future revenues and value that the business could generate, but provides an estimate of the minimum value of the company, approximating the possible liquidation value or replacement value of the business.

The advantages of the Net Asset Value approach can be listed as;

Weaknesses of the approach include;

The Market Approach can be summarized in two methods:

Comparable Companies Analysis: In this method, the company being valued is compared with publicly traded companies that are financially and operationally similar. Valuation multiples of similar companies such as;

are taken into account to arrive at the market value of the target company.

Comparable Transactions Analysis: In the second basic method, comparable transactions analysis, the mergers and acquisitions of similar companies in the world are researched, the valuation multiples of these transactions are analyzed and the results of the analysis are compared with the target company's size. The geography and size of the company subject to the transaction are taken into account when selecting comparable transactions.

The advantages of the market approach are that;

The weaknesses of the approach are that;

This approach focuses on the income that an asset generates for its owners. This income is measured by the cash flows expected to be realized over the useful life of the asset. The value of the asset is determined by discounting the expected future cash flows to their present value. The discount rate used includes the time value of money together with the risk that the asset will not generate the expected cash flows.

Under the Income Approach, the Discounted Cash Flow method is the most widely used technique.

In this method, the company's current structure, customer portfolio, market share, service potential, creativity, organization and management team, and the cash flows expected to be generated by the company in the future are analyzed. As a result of this analysis, the future cash flows are discounted to the valuation date. The discounting process is carried out by applying a discount rate to the cash flows in line with market conditions and in accordance with the risk profile of the company. In calculating this discount rate, the Capital Asset Pricing Model is generally used. In this method, the value of the company is the sum of discounted cash flows and non-operating assets. While calculating the equity value, the market value of the bank loans available as of the valuation date can also be taken into consideration. While calculating the share values of the company with this method, separate valuations can also be made for its subsidiaries or the book value in the balance sheet can be taken into account.

The advantages of the revenue approach can be listed as follows;

Weaknesses of the approach are;

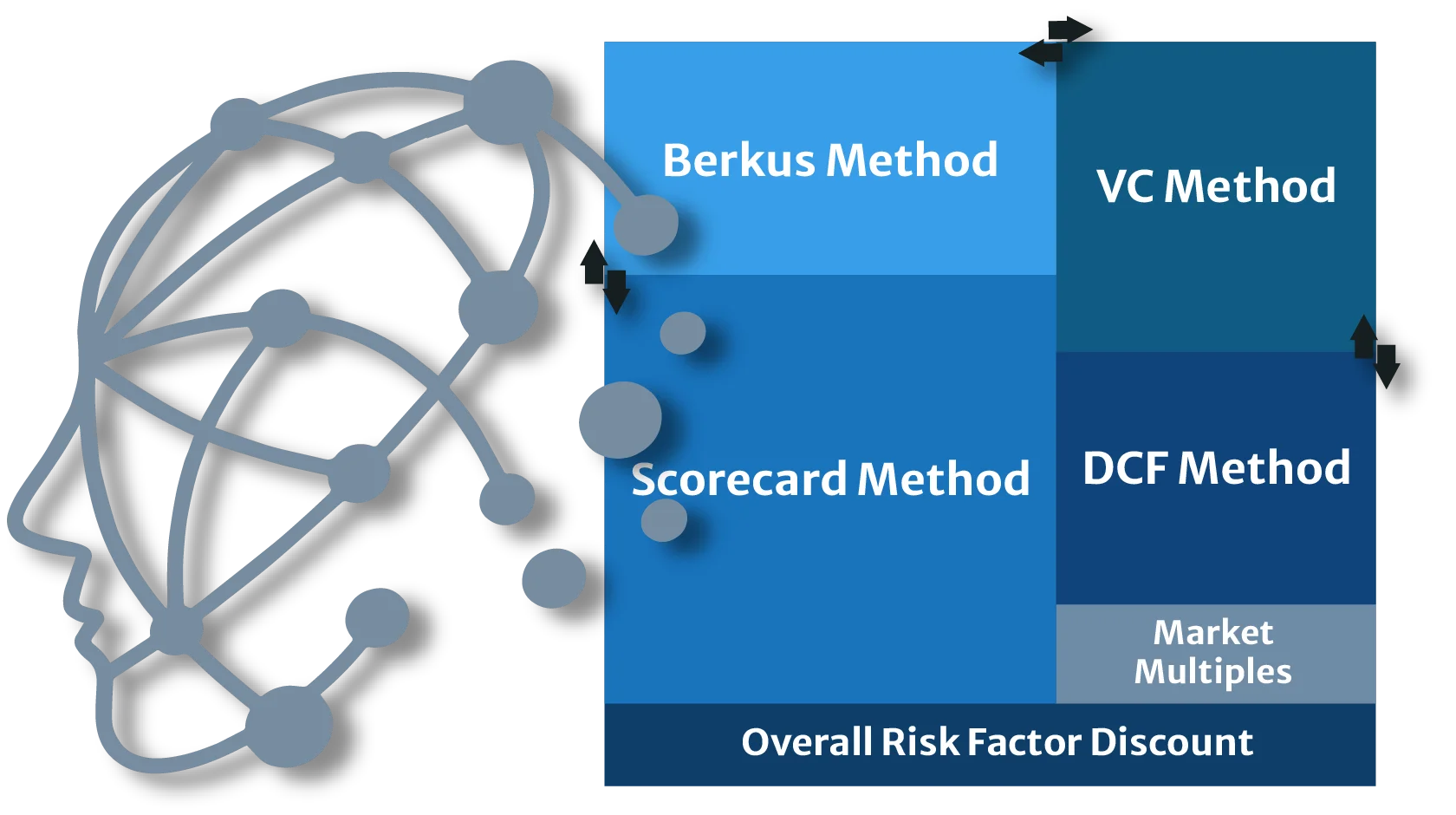

The traditional 3 basic valuation approaches are dysfunctional and/or inadequate for the valuation of early stage startups. For this reason, the following approaches have been developed:

The scorecard valuation method was first formulated in 2001 by Bill Payne, a US-based angel investor and startup mentor. It is a popular, pre-money valuation method for early-stage startups.

In this method, a startup is valued based on an adjusted benchmark value. The central idea is that a startup should be valued in line with comparable startups (similar in terms of geographical location, industry, market potential, and development stage). Next, the benchmark value is adjusted to reflect important nuances that justify a lower or higher valuation.

The scorecard valuation method compares the target company to similar companies on the following 6 parameters.

These factors are ranked from most important to the least important. The strength of the management team and the size of the opportunity are the dominant factors and together account for more than half of the total valuation. In contrast, the requirement for additional funding only accounts for a minor share.

Designed by Dave Berkus in the mid-1990s, the Berkus Approach is a fast and effective method for valuing very early-stage ventures, especially those that have not yet begun to generate revenue.

It focuses on evaluating a startup through a detailed examination of five key success factors:

A comprehensive analysis is carried out to determine in quantitative terms how much these five main success criteria contribute to the total value of the enterprise. Maximum monetary values are assigned to each success factor and these values are adjusted according to how the target venture compares to similar ventures.

For startups whose business model is commercialized and starts generating revenue, the Berkus method becomes obsolete.

The risk factor method, developed for early-stage ventures, is a pre-money valuation method that, like other qualitative valuation approaches, compares the startup with similar companies.

It bases the company’s valuation on a comparable startup’s base value, and this baseline value is then modified for a total of 12 risk variables. This means that your startup is being compared to other startups to determine whether you are at a higher or lower risk.

The Venture Capital Method takes a finite term approach to the valuation method. The investor assumes an exit term, say 5 or 7 years, from the point of investment. It then back-calculates the return on investment for that period.

This is one of the preferred startup valuation methods. An investor can set the exit strategy on milestones. An example milestone would be reaching a specific dollar amount in sales or percentage of market share.

In this startup valuation method, first the terminal value is estimated. Terminal value is the expected value of the startup during the harvest year, the year when the investor plans to exit. From this point, the pre-money valuation is calculated using the following formula:

VC Valuation =

Terminal Value

(1 + Discount Rate) ^ Years

Terminal Value = (EBITDA of Last Projected Year) X Industry Multiple

The annual discount accounts for a high year- on-year Return on Investment (or ROI). They are based on criterias such as VC expected return multiples, timing, and dilution.

From Valufy's perspective, each start-up needs to be individually evaluated with a tailor-made approach. However, managing this with conventional methods and human resources leads to huge time and cost inefficiencies.

Valufy's authentic algorithm provides the most consistent, accurate and objective market valuation based on the unique characteristics of each start-up (country, sector, stage, etc.).

The Valufy algorithm combines the quantitative valuation approaches (market approach, revenue approach, VC approach) and next-gen qualitative startup valuation approaches (Berkus, Scorecard, Risk Factors) and weights them optimally for each scenario to create the final methodology mix.

Benchmark data obtained through direct integration with reliable and independent international data sources ensures the most up-to-date market value.